Understanding MOOP: Why It Matters for Your Medicare Advantage Plan

- lancewilsonhealth

- 3 days ago

- 2 min read

When choosing a Medicare Advantage plan, one term you’ll often hear is MOOP, or Maximum Out-of-Pocket. It’s more than just jargon—it’s a critical factor that can protect your finances and give you peace of mind. Let’s break down what MOOP means, what counts toward it, what doesn’t, and why it’s so important.

If you don't have a Medicare Part C Plan, you don't have a MOOP. Contact me today and I can help you get one set up.

What Is MOOP?

MOOP is the annual spending cap on covered in-network medical services under a Medicare Advantage (Part C) plan. Once you reach this limit, your plan pays 100% of covered costs for the rest of the year.

Example:

In 2025, the maximum MOOP allowed by CMS for in-network services is $9,350, but many plans offer much lower limits.

Some plans have MOOPs as low as $3,400–$5,000, which can make a huge difference if you need frequent care or major procedures.

Why this matters: Original Medicare has no MOOP, meaning your out-of-pocket costs could be unlimited. With Medicare Advantage, you have a financial safety net.

What Counts Toward MOOP?

Deductibles: The amount you pay before your plan starts covering costs.

Copayments: Fixed amounts for doctor visits, hospital stays, or other services.

Coinsurance: Your share of costs for covered services, usually a percentage.

Emergency & Urgent Care (In-Network): These costs typically count toward your MOOP.

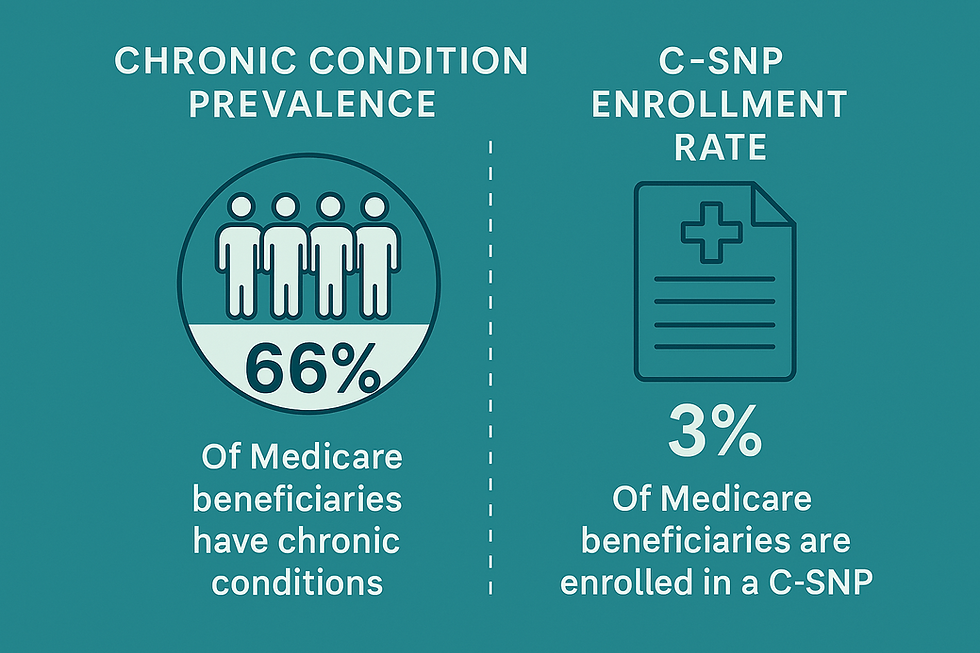

Tip: If you have chronic conditions or expect multiple hospital visits, these costs can add up quickly—MOOP ensures you won’t pay beyond a certain point.

What Does NOT Count Toward MOOP?

Monthly Premiums: Your plan’s monthly cost is separate.

Prescription Drug Costs: Part D expenses are tracked separately.

Dental, Vision, Hearing: Unless included in your plan, these extras don’t count.

Out-of-Network Costs: For PPO plans, some out-of-network costs may apply partially, but HMO plans typically exclude them.

Non-Covered Services: Cosmetic procedures, elective treatments, and services outside Medicare guidelines.

Supplemental Benefits: Gym memberships, over-the-counter allowances, and other perks do not apply to MOOP.

Why Is MOOP Important?

MOOP isn’t just a number—it’s your financial safety net. Here’s why:

Protects Against Catastrophic Costs: Unexpected hospital stays or surgeries can cost tens of thousands. MOOP caps your exposure.

Predictability: You know the maximum you’ll pay for covered services in a year.

Encourages Care: Once you hit your MOOP, you can access covered services without worrying about additional costs.

Budget Planning: Helps you plan for worst-case scenarios and avoid medical debt.

How a MOOP Works

Bottom line: When comparing Medicare Advantage plans, don’t just look at premiums—check the MOOP. A lower MOOP can save you thousands if you need extensive care.

Comments